Fintech Social Media Marketing: Indian Companies & Their Social Media Game

In the past decade, fintech companies in India have gotten a lot of limelight, whether in terms of the investment funds secured or the maximum number of startups registered. This sector has emerged as one of the most exciting and competitive in the nation. Considering the large number of fish in the sea, fintech social media marketing has become a powerful sailing vessel in this journey.

Unless you live under a rock, you must be aware of the power of social media, especially for marketing and brand building. Everybody wants to harness social media’s reach, whether big tycoons or small businesses. And fintech companies in India are no exception.

Fintech Social Media Marketing – An Overview

Lately, the role of fintech social media marketing has become quite significant. Several factors are involved in this dynamic. One of them is the paradigm shift of the target audience. Let’s take a moment and try to understand this.

Traditionally, the finance industry was quite complex and inaccessible. Only a handful of people, like urban residents, could think of trading and investing in the stock market. However, things have changed for good with digitalization and technological advancements in fintech. Anyone with a stable internet connection and a demat account can invest and trade in equity. With this, the youth of India can have hands-on trading and investing experience.

Thus, fintech companies in India are increasingly targeting a younger audience, including Gen Z and millennials. Targeting this age group with social media perfectly aligns with their business model of customer loyalty. As these demographics mature, they are expected to become the core audience for fintech firms in the coming years.

In this blog post, we will explore the fintech social media marketing strategies employed by the top companies in India. We will explore their follower base, engagement rates, content strategies, and unique differentiators. You will be amazed to know these companies in the same sector have different social media strategies to engage with their audience.

Let’s get started.

Top Companies and Their Fintech Social Media Marketing Strategies

This section explores the top fintech companies in India today.

GROWW

Since its founding in April 2016, Groww has won many awards and many hearts. The Groww community has more than 1M members across all platforms and is still growing!

The content retains its educational premise while being trendy and youth-friendly. If we describe it in one term, it would be Edutainment.

As you can see above, Groww’s content is not merely about words; it has it all – infographics, emojis, and quirky captions.

Groww also has a solid social media presence across all platforms. This has created a powerful brand persona and enabled the company to successfully reach not only urban areas but also suburban and rural areas.

“At present, 60% of Groww users hail from tier 2 and 3 cities, and 60% of these are first-time investors.”

In line with their commitment to empowering investors and closing the knowledge gap, Groww has launched an innovative financial education initiative called “Ab India Karega Invest” (Now India Will Invest). This program aims to equip investors with the knowledge and skills to make informed financial decisions.

With over 30+ million registered users, the fintech giant stands tall as a trustworthy, reliable, and new-age company.

Zerodha

Founded by the Kamath brothers in 2010, Zerodha is one of India’s most successful bootstrapped startups. Two boys who began trading at 17 started their entrepreneurial journey and are now helping more than 6 million people in trading and investing.

With minimal design and a goal-oriented approach, Zerodha has successfully dethroned ICICI Securities and become India’s largest brokering firm.

It has created a community of 1M, the greater part being the Twitter audience.

Zerodha’s content decodes complex financial concepts simply and playfully. Its social media presence is hot and approachable. The company has created a brand persona that emits trustworthiness, making customers feel welcomed and valued.

Now that you have seen the look and feel and strong presence nationwide, what if we tell you that Zerodha has yet to spend money on advertisements to date? Yes, you heard it right; Zerodha works totally on word of mouth and value added to users by the company.

The success story of Zerodha is an integration of work ethics, a user-centered business model, and effective fintech social media marketing.

Cred

CRED is a portal that allows users to make payments through credit cards and provides exclusive rewards in return. It has created a community of more than 800K across all platforms.

CRED’s marketing is one of a kind. The company hires comedians to write the script and collaborate with the sportsperson in unique and unexpected ways.

One can find well-known figures such as the graceful Madhuri Dixit and a screaming Gautam Gambhir on the screens of CRED. Its commercials and social media copies leave the viewer stunned and sometimes confused.

On the one hand, where a company like Zerodha spends zero money on advertising, CRED has spent more than half its annual budget on marketing and advertising.

While most fintech companies in India aim to make their ads relatable and inclined towards real-life scenarios, CRED does the exact opposite. CRED doesn’t discuss its benefits and features but comes up with unfathomable scenarios for digital media with a call to action to download the app.

Unlike other fintech brands that want to portray themselves as safe, secure, and reliable, CRED has decided to turn heads with strange yet clever fintech social media marketing campaigns. Whether the out-of-the-box IPL campaign with Anil Kapoor or collaborating with the gold medalist Neeraj Chopra, CRED has never failed to amaze its viewers.

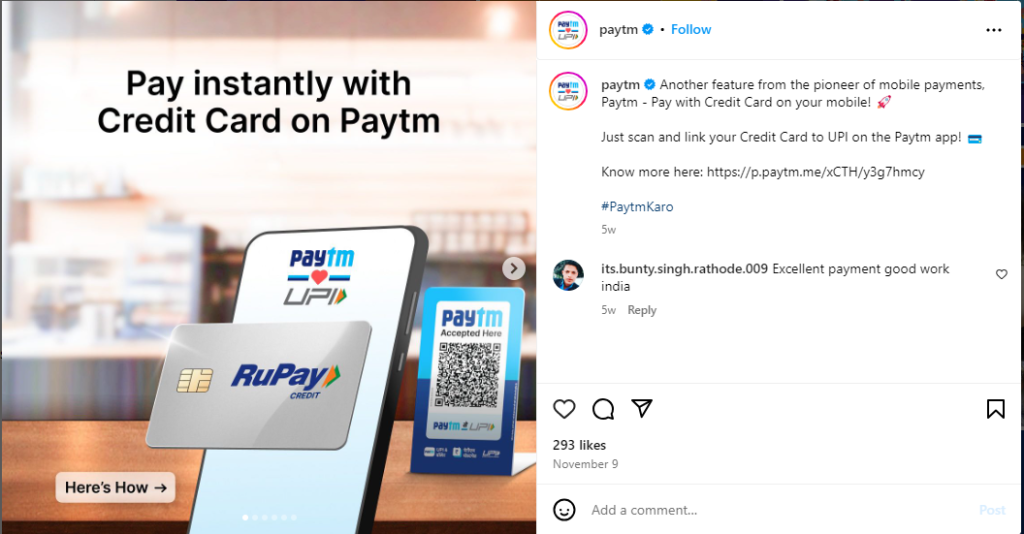

Paytm

Founded on the clever acronym “Pay Through Mobile, ” Paytm is now one of the biggest fintech companies in India.

Paytm had around 40 million transactions in 2014-15, surging from 450 to 500 million in 2019-20. That’s a mammoth 10X in less than five years. This achievement integrates value added to the user, brand awareness, and strong marketing in tier 2 and tier 3 cities.

The Paytm community on social media counts over 5 million across various platforms. Its straightforward content and real-life stories have yielded great success. In terms of social media, it comes across as a friendly, approachable, and easy-to-understand brand.

This has empowered the brand to enter different sectors, like digital gold, e-wallets, and Paytm payments bank.

The company always finds new ways to connect with honest India, be it its collaboration with Mumbai Dabbawalas or with GenZ influencers. This has made the whole nation resonate with the tune of “Paytm Karo!”

“Paytm” is no longer a noun but has become a verb.

With its fintech social media marketing efforts targeted at India’s lower to middle-class economy, the Paytm QR code is everywhere. It can be observed in a luxury showroom as well as a Pani-Puri stall. This strong presence has made Paytm the king of merchant payments, with a network of more than 30 million merchants network.

With its fintech strong media marketing presence, Paytm has become one of the most reliable brands in the nation.

PolicyBazaar

Established in 2008, PolicyBazaar started as a company that compared insurance policy prices and provided insurance-related information. Now, it is a reputable insurance marketplace that helps you to renew and cancel policies and settle claims.

Traditionally, Indian consumers used to buy insurance from agents, and it was difficult to penetrate the existing networks of such agents nationwide. As a new concept, PolicyBazaar needed to win consumers’ trust. Its strong fintech social media marketing effort, along with its company features and benefits, has made this possible.

PolicyBazaar holds a community of almost 200K across all platforms. More than selling the product, the company aims to sell the emotion. Insurance is a tool that protects families in unfortunate and unforeseen circumstances. PolicyBazaar’s content displays a similar sentimental value.

Similar to PayTm, PolicyBazaar is also a big believer in selling products with real-life stories. The company is cautious about its brand persona and the sensitivity of the product.

Policybazaar also tries creative things to reach its target audience. They have their own podcast series called “askPB,” where they break down the technical aspects through storytelling.

Razorpay

Razorpay, one of the most widely used fintech companies in India, was launched in 2014 by two friends who met at IIT Roorkee and decided to help small to medium enterprises (SMEs) with their payment gateway.

They saw a gap – SMEs need an easy platform to carry out their financial transaction and thus aimed to bridge this gap. Although the idea may sound attractive, putting it into action took a lot of work. Small and medium-sized businesses (SMEs) in India have individual methods of managing their financial records.

However, convincing these companies to transition to a digital platform was a daunting task. But, the company accomplished this through effective fintech social media marketing and advertising.

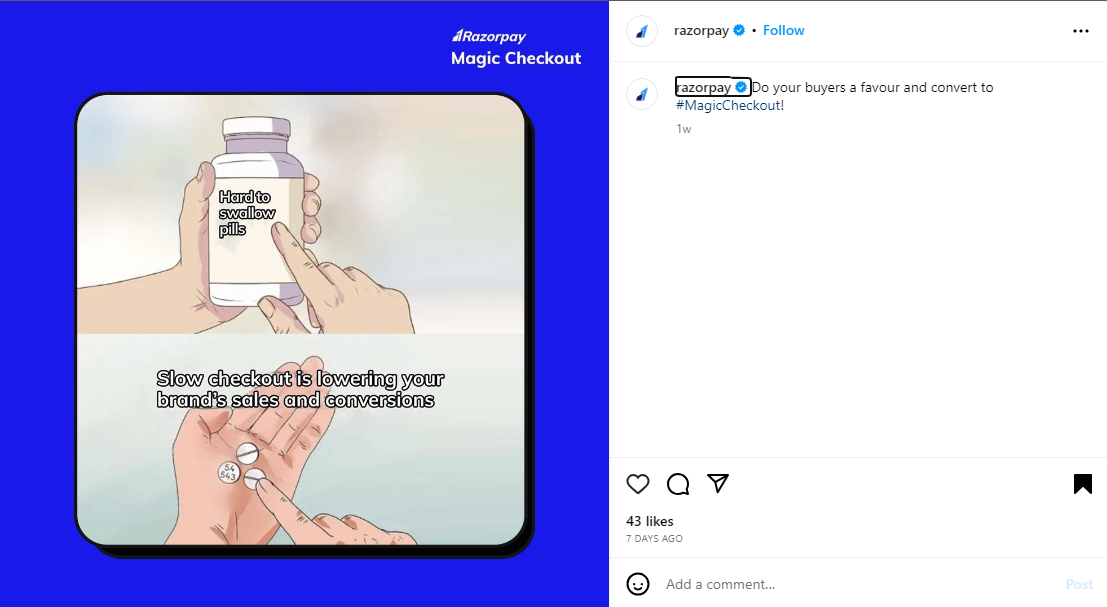

Razorpay’s fintech social media marketing targets a community of over 600K across all platforms. The company’s target audience is owners of SMEs who are of the age group 26 to 45.

The company creates enticing content to attract these minds, a blend of entertainment, educational, and motivational. And it never misses any trends that can make the company reach its target audience. Here’s what their Instagram profile looks like.

These include case studies of recent startups and inviting entrepreneurs for the talk show. Razorpay always tries to be near the youth and create a hammering marketing effect. The company has safeguarded transactions of 50,00,000+ businesses.

The company further aims to explore the scope of AI and Blockchain in this fintech business and explain the same to its users by leveraging social media marketing and advertising.

The Bottom Line

In essence, every company today needs to be a social media company.

Fintech social media marketing has become an integral part of any successful company’s strategy. It allows them to connect with their target audience, build brand loyalty, and drive business growth. With the right content and a deep understanding of their customers, fintech companies in India can leverage social media to their advantage, leaving a lasting impact in the digital landscape.

If fintech companies in India want more data, they must strive for more installations of their digital platform. To achieve more installations, it requires increased awareness. And to generate that awareness, the company must create compelling content that people can’t help but share. As social media users have gone beyond merely consuming content, they have developed a strong addiction to sharing it. Consequently, their expectations for share-worthy content from their favorite brands have also increased.